Earnings Before Interest and Taxes (EBIT)

Understanding profitability is key for investors. However, there are several ways to look at it.

The basic idea is to calculate the revenue that a company makes within a certain time period, such as a quarter or year, after expenses are deducted.

Accounting has several terms for earnings, which you can think of as rungs on a descending ladder as more and more types of expenses are removed. Each level then provides critical insights into how different parts of the business are doing.

This article looks into one of these calculations, Earnings Before Interest and Taxes (EBIT).

Below is everything you need to know about EBIT, including uses, limitations, how to calculate it, and how it compares to other measures of profitability.

What is EBIT?

EBIT stands for Earnings Before Interest and Taxes.

As the name indicates, EBIT is a company's income before interest and taxes are deducted, so what is left of the revenue after deducting all the costs that have gone into creating the goods, such as raw materials, wages, or rent.

This means that EBIT has most — but not all — expenses deducted. So while it doesn't tell you about final performance, it helps clarify how well the company is generating earnings from its core functions, before its capital structure and tax requirements are considered.

Note that EBIT does include the effects of long-term capital spending, also known as depreciation and amortization, on items like new machinery or plants.

In some cases, especially in capital-intensive industries, EBIT can be more useful than EBITDA, which doesn't include the effects of depreciation and amortization.

On income statements, EBIT is sometimes listed as operating income, though this can differ.

SummaryEBIT is a measure of profitability that indicates the company's ability to generate earnings from its core business. EBIT also shows whether the company has enough earnings to manage its capital structure, such as funding operations and paying debt.

How is EBIT calculated?

EBIT can be calculated either by moving down the rungs of the ladder and subtracting the appropriate costs from revenue, or by climbing up from net profit and adding costs back in.

Below are the formulas for both calculations.

EBIT formula

The first way to calculate EBIT is as follows:

EBIT = revenue - costs of goods sold (COGS) - operating expenses

Example (in USD millions):

| revenue | = $10M |

| - COGS | = $5M |

| - operating expenses | = $1M |

| EBIT | = $4M |

Alternative EBIT calculation

Alternatively, EBIT can be calculated from net income by adding back in interest and taxes, so going back up the rungs of the ladder to where fewer costs have been taken out.

Here is the formula:

EBIT = net income + interest + taxes

SummaryThere are two ways to calculate EBIT, either “revenue – costs of goods sold (COGS) – operating expenses” or “net income + interest + taxes."

Where can you find EBIT?

EBIT is found on the income statement, along with other levels of earnings. Generally, you'll find it quite far down on the income statement.

Sometimes, you may need to calculate EBIT yourself, as companies do not always provide it. It's often shown as operating income, although these terms are not exactly the same.

The EBIT formula uses the earnings from all activities, which may include non-core operations like investing or the sale of goods, whereas operating income is calculated purely from operating revenue, which is only revenue generated from core operations.

When it comes to disclosing earnings, companies are required to publish this information quarterly as well as annually, so it will be listed for those periods.

SummaryEBIT information is found on a company's income statement, alongside all its earnings, which are published quarterly and annually. Sometimes, you may need to calculate EBIT yourself.

Why is EBIT useful?

EBIT is about operating efficiency, as it shows how well a company is generating earnings from its core functions before capital structure and tax requirements are considered.

As such, EBIT indicates whether a company is in a strong position to continue with its operations and pay off debt.

You can also compare a company's EBIT year over year, which lets you know if the company is getting better or worse at generating earnings from core operations.

A company's EBIT can be compared to that of other companies within the same sector as well, helping you develop an opinion about relative performance.

Since neither tax nor interest payments are taken into account, an investor can use EBIT to compare how companies within the same sector are doing in terms of their basic business functions, without the information being confused by tax breaks or bad debt management.

EBIT is particularly useful when companies are capital-intensive, meaning they have a lot of fixed assets, as is the case in oil production or mining, for example. You'll be able to see these fixed assets on their balance sheets.

Although there is some debate about this, these companies must spend on their capital assets to function, so including this cost via depreciation seems a reasonable approach.

SummaryEBIT shows how well a company is making money from its core functions. You can also compare a company's EBIT year over year or to the EBIT of other companies, thus getting a clear sense of performance.

Limitations of EBIT

While EBIT is a very useful calculation, it can have some limitations.

As you may expect, these limitations are centered on the fact that EBIT takes into account the impact of depreciation and amortization, but not capital structure or tax.

In sectors or companies where any of these expenses are particularly high or low, EBIT may give an unfair picture of operating earnings.

As an example, say you're comparing companies in different industries, where one has many fixed assets and one does not. The first company's EBIT will be impacted significantly by depreciation costs and the second company's earnings may look unfairly high.

In this case, it may be more useful to compare operations using EBITDA.

Furthermore, for capital-intensive companies, EBIT doesn't take into account any high interest payments if those assets have been funded by loans.

In such cases, the company is paying interest on these loans to carry out its core functions and so, again, EBIT may look unfairly high. Such companies are also potentially much more vulnerable to interest rate increases.

SummaryIn sectors or companies where certain expenses are particularly high or low, EBIT may not tell the whole earnings story. It also doesn't take interest payments or rates into account.

What's the difference between EBIT and EBITDA?

Depending on what you want to analyze about a company's profitability, there are several earning “levels” with different expenses deducted and/or sources of income added.

These are useful for understanding different aspects of the company's profitability.

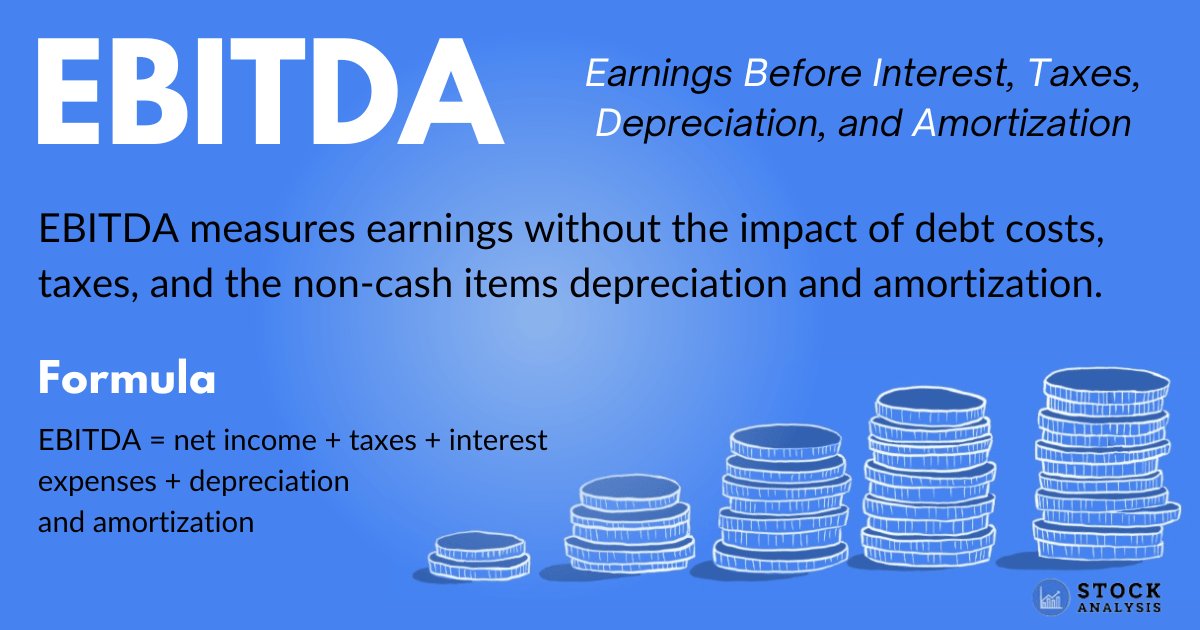

Another important measure of profitability is EBITDA, or Earnings Before Interest, Taxes, Depreciation, and Amortization. Depreciation shows the loss in value of an asset as it ages, whereas amortization is a method used to reduce the cost of an asset over a set period.

As you can see, EBIT and EBITDA are closely related, yet fundamentally different.

Both numbers have the costs of interest and taxes removed, but EBITDA also has the impact of depreciation and amortization removed since it is the earnings before these costs are deducted. EBIT, on the other hand, is the net of these costs.

Note that EBIT and EBITDA are telling you what costs still need to be removed, that is, they are earnings before these expenses are deducted. Thus, EBITDA will be larger than EBIT.

How do you calculate EBITDA?

Depending on whether you want to start from the “bottom line” net income number, or from the larger operating income (which is EBIT + non-operating income), here's how to calculate EBITDA:

EBITDA = operating income + depreciation + amortization

or

EBITDA = net income + taxes + interest expense + depreciation and amortization

Which is a better measure, EBIT or EBITDA?

There is a lot of debate about whether EBIT or EBITDA is a better measure. Often, there is a norm for each industry, although many investors have a personal preference.

For low capital-intensive industries, the amount being spent on depreciation is relatively low by definition and so the difference between EBIT and EBITDA will be less.

But in capital-intensive industries — that is, industries like oil, gas, or mining — where the difference between EBIT and EBITDA is greater, investors may have a strong preference.

Some believe that the purchase and depreciation of capital investments, like machinery, are a part of running the business and need to be counted, thus preferring EBIT.

Others argue that capital spending is often to improve efficiency or growth prospects, thereby improving future earnings and competitiveness, so is better taken out of the mix via EBITDA.

By comparing EBIT to EBITDA, you can understand these differences and decide how you want to look at earnings. Assessing whether this difference is good or bad depends on how the calculations compare to previous periods as well as competitors in the same sector.

Furthermore, stock prices can be affected by differences in analysts' expectations versus actual figures.

SummaryEBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. It's similar to EBIT, as both calculate earnings before interest and taxes, but EBITDA also removes the impact of depreciation and amortization.

How profitability metrics compare

Depending on what you want to analyze about a company's profitability, there are several earning “levels” with increasing numbers of costs and/or expenses taken off and sources of income added.

These “levels” can be visualized as descending rungs on a ladder, decreasing as you subtract more types of costs from the top line, or revenue, that the company has generated.

Some include the revenue and expenses from the core business only, while others include revenue and expenses from other sources, such as investments.

Here is an overview, starting from the top of the ladder.

Gross profit/income

This is the most basic measure, as it simply subtracts the direct cost of producing the goods or services that are the company's main business. It ignores all other costs, like selling those goods or taxes.

On the other hand, it lets you see how efficient the core business of the company is.

This doesn't need to be shown on the income statement.

EBITDA

While not recognized by the Generally Accepted Accounting Principles (GAAP), this is used by some companies to show cash profit from their core business.

It excludes the effects of expenses, like new machinery, being spread over longer time periods rather than just the current income period. Any investments with a lifespan longer than one year can be depreciated, to spread the cost of them over their lifetime.

EBIT

This is the earnings before the interest and tax slices have been cut out, but after most of the other expenses have been removed. Thus, EBIT is going to be a smaller piece of the remaining pie than most other “earning” numbers.

Operating profit

This is the net earnings from the company's core business before interest and tax, but it doesn't include other sources of earnings.

It differs from EBIT because it doesn't include non-operating income, such as that from investments or sales of equipment.

So, if a company doesn't earn anything other than from its core business, operating profit and EBIT will be the same. Operating profit is always equal to or less than EBIT.

Pretax profit

Pretax profit gives you the overall picture before taxes are paid, so after any interest payments are deducted.

Net income

This is the profit after all expenses have been deducted from revenue.

It is the most complete of the earnings numbers — that is, the bottom line — however, it does not let you see what aspects of the company's activities are performing well or not.

SummaryThere are several ways to measure a company's profitability, as more and more costs are subtracted from the overall revenue number. It can help to visualize this as a ladder, with gross profit at the top and net income at the bottom.

How to measure profitability using the EBIT margin

When analyzing a company's financials, EBIT can help you understand profitability.

However, it's important to always look at the whole picture and not reach a false conclusion by reading too much into a single number or ratio.

Keep in mind that companies can spend a lot of time making their accounts look as attractive as possible and camouflaging problem areas to make them look less worrisome.

Another useful metric you may want to consider is the EBIT margin, which looks at how efficiently a company generates earnings from its operations, indicating how profitable it is.

Here is the EBIT margin formula:

EBIT margin = EBIT / total revenue

Example (in USD millions):

| EBIT | = $4M |

| / total revenue | = $10M |

| EBIT margin | = 40% |

A higher EBIT margin means that a company is more profitable, generating more earnings for each unit of revenue – that is, it's more efficient at turning revenues into profits.

SummaryThe EBIT margin measures how efficiently a company generates earnings from its operations. It can be a helpful indicator of the larger financial picture of a company.

The takeaway

Like all the other earnings measurements, EBIT is a useful summary of how a company is performing when a number of different factors are taken into consideration.

For EBIT, this includes the effects of all expenses, except for interest and tax.

This calculation can help you get a good grasp of how well the company is generating profits from its core operations before its capital structure and tax obligations are included.

Unlike EBITDA, it does include the effects of depreciation and amortization, so it takes into account the impact of longer-term investment in these core operations.

Although there is some debate about this, the EBIT calculation can be considered particularly useful in industries that must spend heavily on buying long-term assets in order to be able to run their core business.

Overall, EBIT is a valuable calculation to see how profitable a company is, as well as how efficient it is at generating those profits from its core operations.