28 Ways to Invest in Artificial Intelligence in 2026

Artificial intelligence (AI) is changing the way we live — and the technology is still in its infancy.

AI has massive implications for the global economy. There are thousands of use cases for machines to replicate and replace human intelligence, which is why the global AI market is estimated to be worth $2.575 trillion by 2032.

It may be the biggest technological advance in our lifetimes.

The problem is, if you're wanting to invest in AI, it can be hard to know which opportunities to focus on. There are also very few pure-play AI stocks available on the stock market.

Below are several different ways you can invest in AI in 2026. Altogether, there are 28 different stock, ETF, and private market investment options for you to consider.

All data shown herein is as of March 18, 2025.

1–8: Invest in AI stocks

The easiest way to start investing in AI is to buy shares of public companies that are working on the technology in some capacity.

You need a brokerage account to buy shares of stocks. If you're in the market, check out our article on the best brokerage accounts.

While investing in individual stocks is riskier than buying an ETF (more on that in the next section), the potential return is also higher — if you can choose the right companies.

There are two angles to investing in AI stocks.

The first is via companies that are selling the hardware that powers all of AI's uses. The second is to invest in builders — the companies actually creating and deploying the AI systems.

I've divided the AI stocks below into these two categories.

AI tool and hardware companies

These companies provide the essential tools, platforms, hardware, and infrastructure required to develop and implement AI technologies.

- NVIDIA (NVDA) has arguably been the biggest winner in AI so far. It has a market-leading position in the chips used to train and run supercomputers and high-powered AI networks. Additionally, NVIDIA provides a number of supporting services for enterprise clients to develop their AI programs.

- Taiwan Semiconductor (TSM) is the world's largest contract chip manufacturer. That means TSMC doesn't design its own chips — it produces clients' chips. One of its largest customers is NVIDIA. In fact, most of NVIDIA's high-end chip production is done by TSMC.

- Synopsys (SNPS) provides software to help companies (such as NVIDIA) design and produce AI chips.

AI builders

These companies, in contrast, are building and monetizing AI products and services.

- Microsoft (MSFT) has one of the most firm grips on generative AI through its partnership with OpenAI. To date, Microsoft has invested $11 billion in the lab, good enough for a 49% stake in the company and the rights to 75% of the lab's profits. Microsoft is integrating the lab's technology into its Office products and Bing search engine, and has many more AI-based products in its pipeline.

- Alphabet (GOOGL) is working on its own artificial intelligence to use in Google Search, its cloud infrastructure, its tools for developers, its hardware, and more. It's also working on self-driving cars.

- Meta Platforms (META) is once again in the headlines after CEO Mark Zuckerberg reiterated his plans to spend billions of dollars developing generative AI and hardware products. These include the Llama family of LLMs, a conversational assistant (“Meta AI”) to be used across apps and AI-powered smart glasses.

- Amazon (AMZN), in addition to using AI to improve its cloud offering, is adding generative AI to its Alexa devices, product listings, advertisements, payment solutions, and more.

- C3.ai (AI) is a services business that implements AI solutions for its customers. As such, this company sits on the fence between “AI tools” and “AI hardware.”

Neither of these are exhaustive lists. To see more AI companies, check out our list of artificial intelligence stocks.

9–14: Invest in AI ETFs

Instead of picking individual stocks, you may want to invest more broadly in the AI industry via an exchange-traded fund (ETF).

The following ETFs each hold a basket of public companies involved in different aspects of artificial intelligence, making them solid options for anyone who wants to invest in AI but doesn't want to speculate on which specific companies will be winners.

9. Global X Artificial Intelligence & Technology ETF

- Symbol: AIQ

- Issuer: Mirae Asset Global Investments

- AUM: $2.99 billion

- Top 5 holdings: Tencent Holdings (TCEHY), Alibaba Group (BABA), Samsung Electronics (005930), Cisco Systems (CSCO), Apple (AAPL)

- Expense ratio: 0.68%

AIQ invests in companies involved in artificial intelligence and big data in developed countries around the world.

10. Themes Generative Artificial Intelligence ETF

- Symbol: WISE

- Issuer: ALPS Distributors

- AUM: $25.9 million

- Top 5 holdings: Apple (AAPL), Advanced Micro Devices (AMD), Gorilla Technology Group (GRRR), Microsoft (MSFT), NVIDIA (NVDA)

- Expense ratio: 0.35%

WISE invests in companies that derive their revenue from AI, big analytics and big data, natural language processing, or AI-driven services.

11. Global X Robotics & Artificial Intelligence ETF

- Symbol: BOTZ

- Issuer: Mirae Asset Global Investments

- AUM: $2.56 billion

- Top 5 holdings: NVIDIA (NVDA), Intuitive Surgical (ISRG), ABB Ltd (ABBN), Keyence Corp (6861), SMC Corp (6273)

- Expense ratio: 0.68%

BOTZ invests in robotics and artificial intelligence companies across various sectors in the U.S. and international markets.

12. ROBO Global Robotics & Automation Index ETF

- Symbol: ROBO

- Issuer: Exchange Traded Concepts

- AUM: $1.01 billion

- Top 5 holdings: Symbotic (SYM), IPG Photonics (IPGP), Airtac International (1590), Novanta (NOVT), Fanuc (6954)

- Expense ratio: 0.95%

ROBO invests in global companies that are driving innovation through robotics, automation, and AI.

13. ARK Autonomous Technology & Robotics ETF

- Symbol: ARKQ

- Issuer: ARK Investment Management

- AUM: $845.45 million

- Top 5 holdings: Tesla (TSLA), Kratos Defense (KTOS), Teradyne (TER), Archer Aviation (ACHR), Iridium Communications (IRDM)

- Expense ratio: 0.75%

ARKQ invests in companies focused on automation, robots, and related technologies.

14. iShares Semiconductor ETF

- Symbol: SOXX

- Issuer: BlackRock

- AUM: $11.68 billion

- Top 5 holdings: Broadcom (AVGO), NVIDIA (NVDA), QUALCOMM (QCOM), Advanced Micro Devices (AMD), Texas Instruments (TXN)

- Expense ratio: 0.35%

SOXX invests in U.S.-listed semiconductor companies. The companies in this fund are responsible for creating the vast majority of chips being used for AI computing.

This list is not exhaustive. For more investment options, see our list of artificial intelligence ETFs.

15–26: Invest in private AI companies

As mentioned in the introduction, one of the biggest challenges to investing in AI right now is there are very few public companies that are solely focused on the technology.

Microsoft, Amazon, and Google are all developing and will use AI, but they also have (very large) existing businesses. This is the rub with investing in public companies to get AI exposure. Most of these aren't “pure-play” AI investments.

But this isn't the case with private companies.

In fact, there are many privately held, VC-backed companies that are exclusively working on AI technology. And, if you're an accredited investor, you can invest in them.

Accreditation requirements

To qualify as an accredited investor, you must meet one of the following criteria:

- Have an annual income of $200,000 individually or $300,000 jointly.

- Have a net worth that exceeds $1,000,000, excluding your main residence.

- Be a qualifying financial professional.

Hiive is an investment platform that allows accredited investors to buy shares of private companies.

There are many private AI stocks with shares available on Hiive, including:

- Scale AI: Scale AI provides data labeling and annotation services to help train machine learning models.

- Figure AI: Figure AI develops artificial intelligence solutions for various industries, focusing on data analysis and optimization.

- Anthropic: Anthropic works to advance AI research and development, particularly in areas like natural language processing and machine learning.

- Cerebras Systems: Cerebras Systems designs and manufactures high-performance artificial intelligence hardware, specifically large-scale AI processors.

- Databricks: Databricks offers a unified analytics platform that enables data engineering, data science, and analytics on big data and AI.

- ThoughtSpot: ThoughtSpot provides a search and AI-driven analytics platform, allowing users to analyze and visualize data through natural language queries.

- Chainalysis: Chainalysis provides blockchain analysis tools and services to governments, businesses, and financial institutions to detect and prevent cryptocurrency-related crimes.

- Anduril: Anduril develops defense technology solutions, including artificial intelligence-driven surveillance and security systems.

- Boston Dynamics: Boston Dynamics creates advanced robotics and AI systems known for their dynamic and agile robots like Spot and Atlas.

- Miso Robotics: Miso Robotics develops robotics and AI solutions for the food service industry, particularly focusing on automation in commercial kitchens.

- Consensys: Consensys builds blockchain and decentralized applications, providing tools, infrastructure, and solutions for blockchain development and adoption.

- Groq: Groq designs and produces high-performance AI accelerators for deep learning tasks, aiming to improve computational efficiency in AI workloads.

If you qualify as an accredited investor and want to gain direct exposure to companies on the cutting edge of artificial intelligence, you should check out Hiive.

For more information on Hiive, read our Hiive review.

27–28: Invest in private funds with AI exposure

Given how little information on private companies is publicly available, you may prefer to invest in them via a fund.

Each fund has its own manager and team of analysts who evaluate startups full time. They're likely to be more knowledgeable than you about the companies they're investing in. In theory, this would eliminate some of the potential risk.

Similar to an ETF, investing in private companies via a fund also gives you broad diversification to a basket of companies, all in a single investment.

These funds might also make for more liquid investments, though I'd still recommend having a long-term investment outlook.

Here are two options:

- ARK Venture Fund: The ARK Venture Fund invests in disruptive technology companies. Its top holdings are SpaceX, Epic Games, and OpenAI. Accredited investors can invest via the company's website and retail investors can invest via SoFi.

- Fundrise's Innovation Fund: Fundrise's Innovation Fund invests in high-growth, private technology companies and has stakes in OpenAI, Anduril, and Anthropic. It is available to both retail and accredited investors via the website.

Accredited investors and qualified purchasers have access to many more private fund offerings, like private equity and hedge funds. You can read more about that in this article.

How should you invest in AI?

If you're not sure which of the four ways outlined above is the best way for you to invest in artificial intelligence, here's a table summarizing the options:

| Public stocks | ETFs | Private companies | Private funds | |

| Benefits | Available to anyone | Available to anyone; great for diversification | Direct exposure to pure-play AI investments | Available to anyone |

| Drawbacks | AI exposure is somewhat indirect | Somewhat limited upside | Only available to accredited investors; high-risk | High expense ratios; high-risk |

Pros and cons of investing in AI

Despite its massive potential, there are also risks and challenges to investing in AI:

Pros

- Potential for high returns: While it's becoming more popular, we're still in the very early innings of the technology. AI has the potential to transform countless industries and make businesses much more profitable. There is opportunity for significant returns.

- Ability to improve lives: AI has the potential to automate many repetitive and/or labor-intensive jobs, potentially freeing humans up to work on more fulfilling and less demanding tasks. The possibilities are endless.

- Data insights and decision making: AI may also be able to provide valuable insights from vast amounts of data, which a human couldn't have uncovered. This has a range of applications, from stronger economies to healthier cities.

Cons

- Uncertain return: As with any new technology, it's still unclear how useful it will be. Many companies are pouring billions of dollars into AI projects. If they're unable to create anything meaningful, this will be a waste of resources.

- Legal, regulatory, and security risks: Regulatory scrutiny, compliance requirements, and security measures may hinder the growth and adoption of AI.

- Ethical and safety issues: AI systems may contain bias, may lack transparency, and are difficult to hold accountable for their actions. Many experts believe AI will become much smarter than humans, creating serious issues.

- Privacy concerns: AI systems rely heavily on data, raising concerns about privacy breaches and cybersecurity threats.

Final verdict

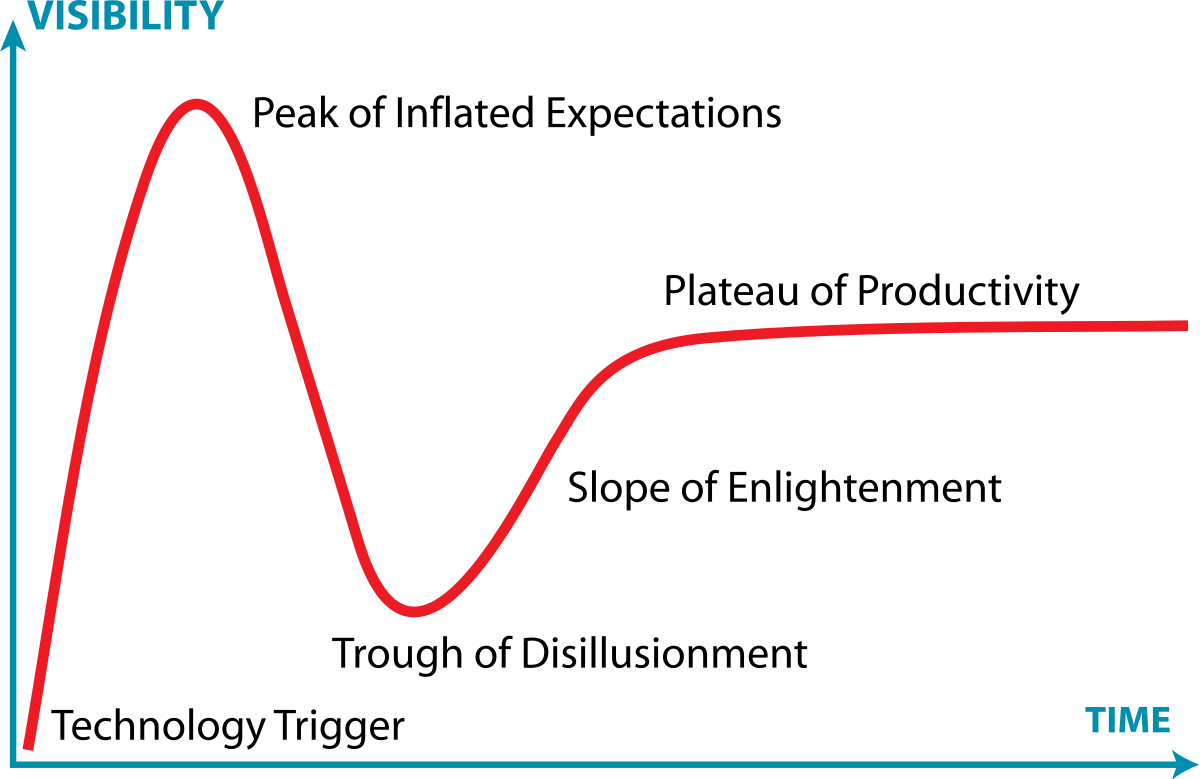

Every new technology brings with it breathless excitement, scores of media coverage, and soaring stock prices.

In fact, this phenomenon is so common that it has its own name: The Gartner Hype Cycle.

Image source: Wikipedia

We saw this exact cycle play out with the dot-com bubble in the early 2000s.

In the late 1990s, it was widely believed that the internet would revolutionize commerce, communication, and the economy.

Businesses and investors poured billions of dollars into internet startups despite many of these companies not having any clear way to generate revenue. Share prices soared, until they didn't.

Eventually, the bubble burst and the only companies that survived were those with legitimate revenue streams.

While we've never seen a technology like AI before, there's an excellent chance it will be subject to a similar cycle. How high it will soar, and for how long, is anybody's guess.

Before investing in AI, do plenty of research on the technology itself and thoroughly evaluate the risks of any investment you're interested in.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited ("Hiive") or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.