45 Ways to Invest in Artificial Intelligence in 2026

Artificial intelligence (AI) is probably the most important technology of the next 50 years.

It's already being used to write marketing copy, generate production-ready code, detect cancer, optimize supply chains, screen for fraud, draft contracts, create images and videos, and more.

Analysts estimate it could add more than $20 trillion to the global economy by 2030.

But for investors, it's not enough to say AI will change the world. You need to predict where the money will actually flow (and when).

Will the biggest winners be the companies building the models? The chipmakers supplying the compute? The data center operators? Or the software companies applying AI to specific industries?

To clarify where you believe value will accrue, it may help to take a closer look at the entire value chain.

The AI stack

When people say “invest in AI,” they often treat it like a single category. It's not.

AI is a multi-layered ecosystem, with different players capturing value at different points in the chain. When a customer pays for an AI tool, that revenue flows down through several layers of companies.

At a high level, the stack looks like this (listed from top to bottom):

| Layer | What it includes | Revenue flow |

| Applications | AI copilots, vertical SaaS, autonomous systems | The customer pays here |

| Tools & middleware | Model orchestration, vector databases, dev platforms | Takes a slice to enable the app |

| Foundation models | Large language models, multimodal models | Charges for API calls or model access (customer may also pay here) |

| Cloud platforms | Hyperscalers, AI infrastructure services | Bills for compute and storage |

| Infrastructure | GPUs, semiconductors, networking, data centers | Sells the hardware that powers it all |

In a healthy, mature supply chain, a dollar flows down the top from the customer, and then some percentage of those dollars go to each player in the supply chain.

Each layer captures a different portion of the economics.

Applications often have the highest margins but the lowest switching costs. Infrastructure companies tend to be more capital-intensive but benefit from massive volume and scale.

Model providers sit somewhere in between, competing on performance, cost, and distribution, but require massive R&D spend.

Looking at the stack this way also helps clarify something important: not every layer is equally investable.

Application and foundation model companies tend to be private and venture-backed. A few could become enormous winners, but access is limited and risk is high.

By contrast, cloud platforms and infrastructure are dominated by large, publicly traded companies.

These businesses are capturing a lot of the real money today, selling the compute, data center capacity, networking equipment, and chips that power the industry.

So while I cover opportunities across the entire stack, the reality is that the most accessible investments today are concentrated in cloud and infrastructure.

With that in mind, here are 45 ways to invest in AI, starting with the areas where public market investors have the most direct exposure.

All data shown herein is as of February 2026.

1–27: Invest in AI stocks

The easiest way to start investing in AI is by buying shares of public companies working in some layer of the stack.

Here's a look at some of the best publicly traded AI companies by category.

You need a brokerage account to buy shares of stocks. If you're in the market, check out our article on the best brokerage accounts. We ranked Public #1.

Disclosure: This is an affiliate link. We may receive compensation if you take action through it.

Foundation models / AI developers

- Alphabet (GOOGL), through Google DeepMind and Gemini, develops leading large language and multimodal models that power search, cloud AI services, and enterprise APIs.

- Microsoft (MSFT) owns 27% of OpenAI and integrates its cutting-edge foundation models into Azure, Copilot, and its enterprise software ecosystem.

- Meta Platforms (META) builds and open-sources its Llama models, positioning itself as a key player in open foundation model development and AI research.

NVIDIA, Microsoft, Amazon, and Google are also major investors in OpenAI and Anthropic, two of the top AI labs and foundation model creators.

By investing in these big tech companies, you also gain indirect exposure to their investments in these labs.

Compute infrastructure

- NVIDIA (NVDA) designs the GPUs that train and run most advanced AI models, making it the central supplier of AI compute globally.

- Taiwan Semiconductor (TSM) manufactures advanced AI chips for companies like NVIDIA and AMD, capturing value at the fabrication layer of the stack.

- Advanced Micro Devices (AMD) competes in AI accelerators and data center CPUs, supplying alternative compute hardware for AI workloads.

- Broadcom (AVGO) supplies custom AI chips and networking components that move massive amounts of data between servers in AI clusters.

- Micron (MU) produces high-bandwidth memory (HBM) and DRAM used in AI servers, a critical component for model training and inference.

Cloud & hyperscalers

- Microsoft (MSFT), through Azure, provides cloud infrastructure and AI services, earning recurring revenue as businesses train and deploy AI models.

- Amazon (AMZN), through AWS, rents compute, storage, and AI services to startups and enterprises building AI-powered applications.

- Alphabet (GOOGL), through Google Cloud, offers AI APIs, model hosting, and data infrastructure, monetizing AI usage at scale.

- CoreWeave (CRWV) provides GPU-focused cloud infrastructure optimized for AI model training and inference, renting high-performance compute capacity to startups and enterprises building AI applications.

- Oracle (ORCL) has recently been increasing its cloud infrastructure footprint to serve AI workloads, particularly in enterprise and government markets.

Data centers & physical infrastructure

- Equinix (EQIX) operates global data center facilities where AI servers and networking equipment are physically housed.

- Digital Realty (DLR) is a data center REIT that provides the real estate and power infrastructure required for AI compute clusters.

- IREN Limited (IREN) develops high-performance data centers powered by renewable energy, increasingly pivoting toward AI hosting.

- ASML (ASML) manufactures extreme ultraviolet (EUV) lithography machines essential for producing advanced AI chips.

- Applied Materials (AMAT) supplies semiconductor manufacturing equipment used to fabricate cutting-edge AI processors.

- Lam Research (LRCX) provides wafer fabrication equipment critical to building advanced chips for AI accelerators and memory.

AI software applications

- Adobe (ADBE) embeds generative AI into creative tools like Photoshop and Illustrator, monetizing AI at the application layer.

- Palantir (PLTR) uses AI-driven analytics platforms to help governments and enterprises make data-driven decisions.

- Snowflake (SNOW) provides cloud data infrastructure that enables companies to store, process, and deploy AI models on their data.

- Salesforce (CRM) integrates AI copilots and automation into CRM workflows, driving enterprise adoption of AI-powered software.

AI hardware, robotics, and autonomous systems

- Tesla (TSLA) develops autonomous driving software and AI-powered robotics, applying AI to real-world physical systems.

- Intuitive Surgical (ISRG) builds robotic surgical systems enhanced by AI-driven precision and data analytics.

- ABB (ABBN) provides industrial robotics and automation systems increasingly powered by AI for manufacturing efficiency.

- Rockwell Automation (ROCK) integrates AI and machine learning into industrial automation and smart factory systems.

These are not exhaustive lists. To see more AI companies, check out our list of artificial intelligence stocks.

28–33: Invest in AI ETFs

Instead of picking individual stocks, you may want to invest more broadly in the AI industry via an exchange-traded fund (ETF).

The following ETFs each hold a basket of public companies involved in different aspects of AI, making them solid options for anyone who wants to invest in AI but doesn't want to speculate on specific companies.

| ETF | Symbol | Focus | Best for |

| 28. Global X Artificial Intelligence & Technology ETF | AIQ | Broad AI ecosystem | Diversified AI exposure |

| 29. Themes Generative Artificial Intelligence ETF | WISE | Generative AI | Next-gen AI growth |

| 30. Global X Robotics & Artificial Intelligence ETF | BOTZ | Industrial AI | Robotics & automation |

| 31. iShares Future AI and Tech ETF | ARTY | Emerging AI technologies | Long-term innovation |

| 32. ARK Autonomous Technology & Robotics ETF | ARKQ | Disruptive innovation | High-growth autonomous tech |

| 33. iShares Semiconductor ETF | SOXX | Chipmakers | Infrastructure boom |

This list is not exhaustive. For more investment options, see our list of artificial intelligence ETFs.

34–43: Invest in private AI companies

As mentioned earlier, one of the biggest challenges in AI investing is that many of the most "pure-play" AI companies are privately held, not publicly traded.

But while retail investors generally cannot invest in these companies directly, accredited investors can.

Accreditation requirements

To qualify as an accredited investor, you must meet one of the following criteria:

- Have an annual income of $200,000 individually or $300,000 jointly.

- Have a net worth that exceeds $1,000,000, excluding your main residence.

- Be a qualifying financial professional.

Platforms like Hiive and Forge allow accredited investors to buy shares of pre-IPO companies from existing shareholders. You can create accounts on both platforms for free and browse available listings.

Disclosure: These are affiliate links. We may receive compensation if you take action through them.

Here are some private AI companies you may be interested in:

Foundation model labs

- OpenAI builds large language and multimodal models that power enterprise AI applications globally, developing GPT models and ChatGPT.

- Anthropic focuses on safety-aligned foundation models for enterprise and consumer use. It created the Claude model family.

- xAI (via SpaceX) develops large-scale AI systems like Grok and is now integrated into SpaceX's broader AI and infrastructure strategy.

AI software applications

- Perplexity AI builds and maintains an AI-native search engine that answers questions conversationally, competing with traditional search and AI chat interfaces.

- Cursor develops an AI-powered coding environment that integrates large language models directly into the developer workflow.

- Replit offers browser-based development tools enhanced with AI code generation and collaboration features.

AI hardware applications

- Boston Dynamics develops advanced robots like Spot and Atlas, applying AI to real-world mobility, logistics, and inspection tasks.

- Figure AI builds humanoid robots designed for industrial and warehouse environments, combining AI perception with physical automation.

Compute infrastructure

- Cerebras Systems designs large-scale AI processors optimized for training massive models, competing with traditional GPU architectures.

- Groq develops custom AI accelerators focused on high-speed inference performance and lower latency for AI applications.

If you qualify as an accredited investor and want direct exposure to private companies operating at the cutting edge of artificial intelligence, platforms like Hiive and Forge can provide access.

That said, private investing carries additional risks, including limited liquidity, less transparency, and higher volatility. Position sizing and diversification matter even more in this part of the stack.

For more information on Hiive, read our Hiive review.

44–45: Invest in private funds with AI exposure

While retail investors cannot invest in private AI companies directly, they can invest via a private technology fund.

Similar to an ETF, investing in these funds gives you broad diversification to a basket of companies, all in a single investment.

These funds might also make for more liquid investments, though I'd still recommend having a long-term investment outlook.

Here are two options:

- ARK Venture Fund: The ARK Venture Fund invests in disruptive tech companies. Its top holdings are SpaceX, Epic Games, and OpenAI. Accredited investors can invest via the company's website, and retail investors can invest via SoFi.

- Fundrise Innovation Fund: Fundrise's Innovation Fund invests in high-growth, private technology companies and has stakes in OpenAI, Anduril, and Anthropic. It is available to both retail and accredited investors via its website.

Accredited investors and qualified purchasers have access to many more private fund offerings, like private equity and hedge funds. You can read more about that in this article.

How should you invest in AI?

If you're not sure which of the four ways outlined above is the best way for you to invest in artificial intelligence, here's a table summarizing the options:

| Public stocks | ETFs | Private companies | Private funds | |

| Benefits | Available to anyone | Available to anyone; diversified | Direct exposure to pure-play AI investments | Available to anyone |

| Drawbacks | Somewhat indirect AI exposure | Somewhat limited upside | Only available to accredited investors; high risk | High expense ratios; high risk |

Risks of investing in AI

Despite its massive potential, there are also risks and challenges to investing in AI:

- Valuation risk: Many AI stocks trade at elevated multiples based on future growth expectations, leaving little room for disappointment if revenue growth slows.

- Capital intensity: AI infrastructure requires massive spending on chips, data centers, and energy, and it's still unclear whether the technology can be delivered profitably.

- Competition and commoditization: Foundation models and AI features can become commoditized quickly, making it difficult for companies to maintain durable competitive advantages.

- Regulatory and legal uncertainty: Governments are still defining rules around AI safety, data usage, copyright, and liability, which could increase costs or restrict certain business models.

- Technological disruption: Rapid advances in model efficiency or new architectures could shift value between layers of the stack, hurting companies that overinvest in the wrong approach.

- Privacy concerns: AI systems rely on large volumes of data, raising concerns around data security, personal privacy, and misuse, which could result in lawsuits, reputational damage, or stricter regulation.

- Cyclicality: Semiconductor and hardware companies tied to AI demand may experience boom-and-bust cycles tied to spending surges and slowdowns.

Final verdict

We are living through what could become a generation-defining technology wave.

Artificial intelligence has the potential to reshape entire industries, alter cost structures, and add hundreds of trillions of dollars to the global economy over time.

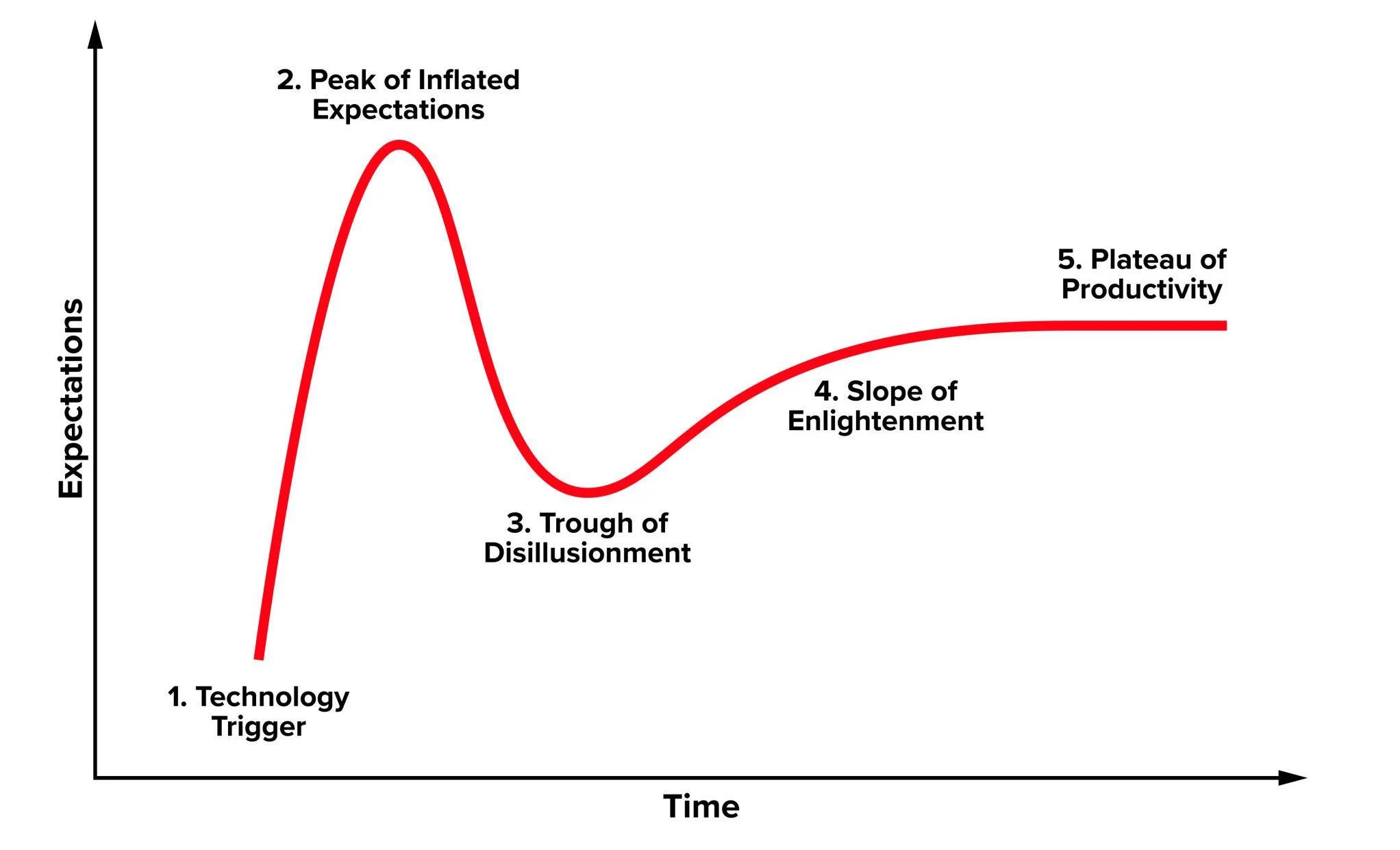

But history offers an important reminder, especially for investors.

Every transformative technology arrives with intense excitement, bold projections, heavy capital investment, and soaring asset prices.

That early phase is often followed by a shakeout, where capital is destroyed, expectations reset, and only the strongest businesses survive.

Image source: Wikipedia

We saw this dynamic play out during the dot-com bubble.

In the late 1990s, investors believed the internet would revolutionize commerce, communication, and the economy in general. They were right about the technology. They were wrong about many of the companies.

Capital poured into unproven business models. Valuations detached from fundamentals. When the cycle turned, more than $5 trillion in household wealth was destroyed, and most companies disappeared.

A small number, with durable revenue and real competitive advantages, emerged stronger and went on to dominate.

AI may follow a similar path.

Yes, the long-term impact could be massive, but the path from here to there is unlikely to be smooth. Some companies will generate revenue profitably, others will struggle once growth slows or venture funding tightens.

For investors, the goal is not simply to “own AI.” It's to understand where value is likely to accrue, what risks you are taking, and how much you are paying for that exposure.

Do your research. Evaluate the economics of the business, not just the technology. And size positions accordingly.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited ("Hiive") or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.