7 Ways to Invest in Private Companies

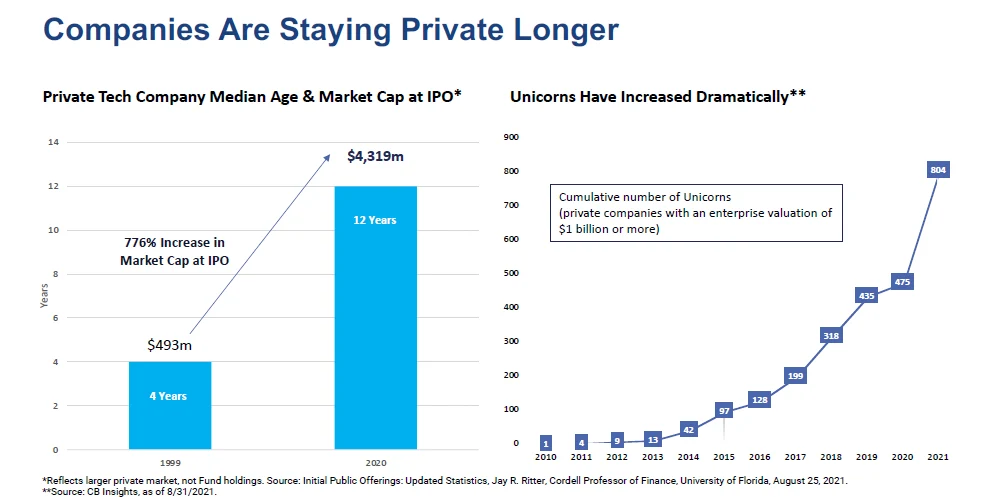

Historically, private companies raised capital from private markets, scaled, and then went public at the earliest possible stage.

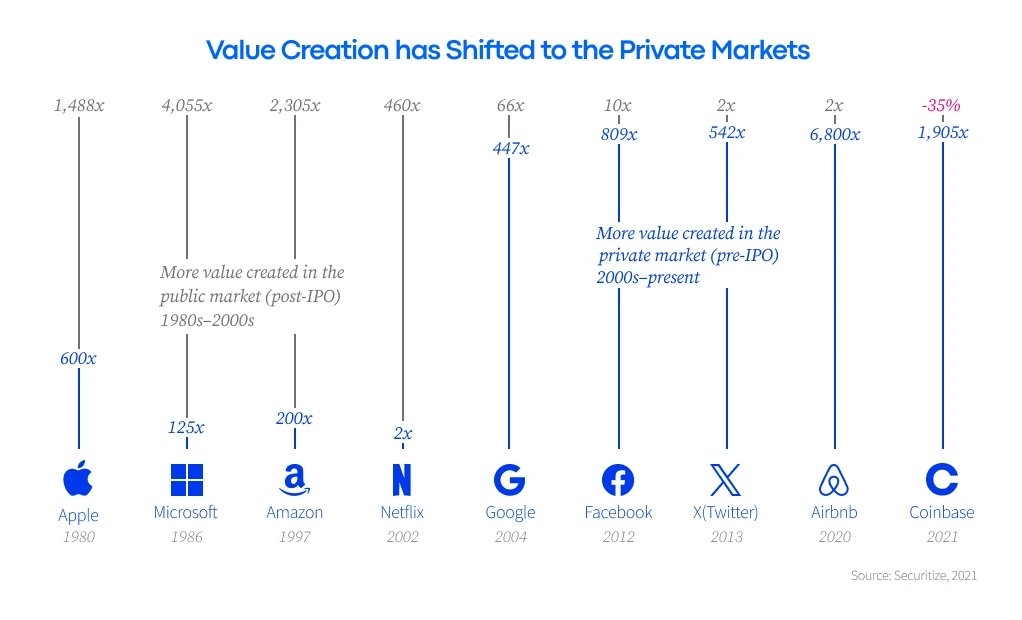

For companies like Apple, Microsoft, and Amazon, the bulk of the value creation — the big returns — happened after the company became publicly traded.

Nowadays, there's a new playbook.

Value creation has shifted to the private markets

Easy access to VC and private equity capital has allowed companies to stay private for longer and reach much larger sizes before going public.

Source: ETF Trends

As a result, much of the wealth creation is realized in the private markets, accruing to venture capital firms and founders.

Nowadays, an IPO is less about raising capital and more about giving VCs their payday.

By the time shares hit the public market, a lot of the growth has already occurred, and retail investors are effectively buying out insiders and funding their windfall.

Source: Linqto

Because of this, most individual investors have been unable to invest in many of the fastest-growing companies.

Until now.

How to invest in private companies

Thanks to regulatory changes and a shift in the investment landscape, there are new opportunities for investors — both accredited and retail — to invest in private companies.

Here are seven of the best ways to invest in private companies in 2026.

1. Hiive

- Type: Pre-IPO investment platform

- Main benefit: Directly own shares of private companies

- Main drawback: For accredited investors only

Hiive is an investment platform where shareholders of pre-IPO startups can sell their shares to accredited investors. Most sellers are current or former employees, venture capitalists, or angel investors.

Note: Most sellers are employees who have received valuable but illiquid shares of the startups they work at as part of their compensation. Hiive allows them to list their shares and receive their cash value from independent investors like you.

After a seller creates a listing, which includes setting an asking price and the number of shares available, a buyer can accept the asking price as listed or place a bid and negotiate directly with the seller.

Buyers can also add companies to their watchlists and receive notifications of any new listings or completed transactions.

Which companies are available on Hiive?

As of the date of publication, all of the following companies (and many more) are available on Hiive:

In all, there are over 3,000 private companies listed and more than $100 million of monthly transaction volume on Hiive.

You can learn more about how investing on Hiive works, including the benefits and drawbacks as both a buyer and a seller, in our Hiive review.

Or, if you're ready to sign up, you can get started with the button below:

2. Fundrise Innovation Fund

- Type: Venture capital fund

- Main benefit: Easily accessible for all investors

- Main drawback: No control over investment selection

The Fundrise Innovation Fund is, in my opinion, the best way for retail investors to gain exposure to a portfolio of private technology companies.

The fund focuses on companies in a few key sectors, including machine learning, data infrastructure, real estate technology, and artificial intelligence.

The fund's most recent investments include OpenAI, Anthropic, Anduril, Canva, Ramp, and Databricks.

The fund managers primarily invest in late-stage businesses that are nearing their IPOs, but may also invest in early-stage startups if they're confident in the underlying business and they can invest at an opportunistic valuation.

The Innovation Fund charges a 1.85% annual management fee on your total investment.

This fee is low relative to the private equity and venture capital industry, which typically charges a 2% annual fee plus 20% of any profits generated.

For more information, check out my Innovation Fund review.

You can make your first investment in under five minutes. Plus, you can get started with as little as $10.

3. Linqto

- Type: Pre-IPO investment platform

- Main benefit: Own shares of private companies directly

- Main drawback: For accredited investors only

Linqto is another secondary marketplace platform where accredited investors can buy shares of private companies. However, its model is slightly different than Hiive's.

Unlike Hiive, which functions like a traditional stock exchange with buyers and sellers negotiating with one another, Linqto serves as a middleman.

On Linqto, sellers sell their shares directly to the platform. After acquiring shares, Linqto marks up the price and offers the shares to buyers on the platform, keeping the difference as its profit.

This model has pros and cons.

The primary advantage is that transactions happen fast and with a high rate of success. Since Linqto has already jumped through the necessary hoops to acquire the shares, buyers benefit from a very straightforward transaction.

Additionally, Linqto's minimum investment is just $2,500.

However, this model also creates an information asymmetry. Linqto makes money by selling its shares for a profit, regardless of where the current price is.

So, for example, if it acquires shares for $40 that are now worth $20, it will still try to sell the shares for $45 (or more). If you don't know the current value of the shares, this could result in unnecessary losses.

For this reason, if you're interested in Linqto, I would also sign up for Hiive so you can double-check that the price you're paying is fair. You can read more about this in my Linqto review.

4. ARK Venture Fund

- Type: Venture capital fund

- Main benefit: Broad exposure to many high-potential private companies

- Main drawback: No control over investment selection

Cathie Wood's ARK Venture Fund invests thematically — any company that fits its criteria of “disruptive innovation” is a candidate for the portfolio.

This includes both public and private companies.

The fund's top 10 holdings, as of July 2025, are SpaceX, xAI, Neuralink, Lambda Labs, OpenAI, Replit, Blockdaemon, Anthropic, Hammerspace, and Mythical.

These are all private companies. In fact, at the time of this writing, 33 of the fund's 50 holdings are private.

ARK charges total fees of 2.90% annually on assets invested (made up of a 2.75% management fee and a 0.15% service fee).

Accredited investors can invest in the fund via the ARK website, while retail investors can invest in it via SoFi.

Compared to the Innovation Fund, the ARK Venture Fund has exposure to a more diverse portfolio of companies, and its managers have more private equity investing expertise.

However, it is also more difficult to access, more expensive, and may be more volatile and risky.

5. Publicly traded private equity funds

- Main benefit: Easily accessible

- Main drawback: Own very few high-profile private companies

While we're on the subject of funds, did you know there are private equity funds you can buy in your traditional brokerage account?

A couple of popular private equity ETFs are ProShares PEX, which has an expense ratio of 2.99%, and Invesco's PSP, which has an expense ratio of 1.79%.

Since these funds trade on public exchanges, they're liquid — you can buy and sell them whenever — and they have low minimums, meaning you can buy fractional shares. They're also highly diversified.

However, if you look at their holdings, you'll see they lack most of the high-profile companies that are owned by the Fundrise Innovation Fund and ARK Venture Fund.

6. Publicly traded asset management firms

- Main benefit: Easily accessible

- Main drawback: Own many different assets, not just private equity

Similarly, you may want to invest in publicly traded venture capital firms and investment holding companies.

A few of the biggest, most popular companies are:

- Blackstone Group (BX) is one of the world's largest alternative investment management firms, specializing in private equity, real estate, hedge funds, and credit.

- KKR & Co (KKR) is an international investment company that oversees a variety of asset types, such as private equity, energy, infrastructure, real estate, and credit. It is one of the largest and most established private equity firms globally.

- SoftBank Group (SFTBY) is a Japanese conglomerate with a significant focus on technology investments, particularly through its Vision Fund, one of the largest venture capital funds globally. SoftBank has invested in companies like Uber, WeWork, and Alibaba.

- Firsthand Technology Value Fund (SVVC) is a closed-end fund that invests in technology and cleantech companies, many of which are still privately held and venture-backed.

- Apollo Global Management (APO) is a leading global alternative investment firm known for its expertise in private equity, credit, and real assets. Apollo has a long track record of acquiring and growing private companies, often in distressed or undervalued situations, and manages hundreds of billions of dollars across its funds.

- The Carlyle Group (CG) is one of the world's largest and most established private equity firms, with a diversified portfolio of investments in sectors such as healthcare, technology, aerospace, energy, and real estate.

These firms actively invest equity into private companies, making them the closest public-market proxy for venture capital and private equity.

However, all of these companies have large portfolios spanning a number of different asset classes.

While buying any of them will give you exposure to their private equity holdings, you'll also be exposed to everything else they own.

7. Angel investing

- Main benefit: Purchase shares of early-stage startups directly

- Main drawback: Need connections and a lot of capital

If you have millions of dollars to invest, connections to high-profile private companies, and experience either running or investing in successful businesses, you may decide to become an angel investor.

Angel investors provide capital to early-stage startups, oftentimes bridging the gap between founders' savings and more substantial funding from venture capitalists.

Their check sizes vary in range but are often between $25,000 and $100,000.

Since they invest in the earliest stages (when the future is most uncertain), angel investors take on substantial risk with each of their investments.

Therefore, most angel investors choose to write a number of checks to different companies, spreading their risk around.

In addition to providing capital, many angel investors offer mentorship, participate in decision-making, and help plan for an exit strategy.

To get started, tap your personal network for introductions to startup founders and communicate your desire to be an angel investor.

Final verdict

Even though it has become more accessible, investing in private companies isn't for everyone. It's risky, volatile, capital-intensive, and illiquid.

However, the potential for high returns and gaining exposure to some of the world's best companies is alluring.

Since the only way to get this exposure is through the private markets, many investors feel they have little choice but to accept these inherent risks.

Still, you should approach investing in private companies with prudence and patience. You may want to add these companies to your investment allocation slowly and keep them as a relatively small portion of your total portfolio.

For most investors, traditional investments like stocks, bonds, and cash should still make up the bulk of a portfolio.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited ("Hiive") or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.